Top Large Cap Mutual Funds to Invest in 2026

Large Cap Mutual Funds are built for investors who want a dependable blend of stability, long-term growth, and reduced volatility. These funds primarily invest in India’s largest and most established companies—businesses that lead their industries, demonstrate strong financial health, and consistently perform across market cycles.

A key strength of this category is its disciplined structure. The top schemes maintain a high large-cap allocation ranging from 81% to 93%, ensuring portfolios remain rooted in strong, fundamentally sound companies rather than highly volatile mid or small caps.

Popular funds such as ICICI Prudential Large Cap Fund, HDFC Large Cap Fund, Edelweiss Large Cap Fund, Tata Large Cap Fund, and Nippon India Large Cap Fund have delivered reliable long-term results, with 5-year returns between ~18% and more than 25%. This showcases the category’s ability to generate steady compounding over time.

These funds also invest heavily in India’s biggest market leaders—including HDFC Bank, ICICI Bank, Reliance Industries, Bharti Airtel, and Larsen & Toubro—companies known for stable earnings, scalability, and strong corporate governance.

Whether you’re planning your first equity investment or optimizing your portfolio for the next year, Large Cap Funds offer the confidence of investing in strong, proven businesses while maintaining a favorable balance of growth and risk management.

Why Consider Large Cap Funds for 2026?

Large Cap Mutual Funds continue to stand out as a smart choice for investors entering 2026, thanks to their unique balance of stability, consistent returns, and strong downside protection. These funds anchor their portfolios in India’s biggest and most reliable companies—businesses that have established themselves through decades of performance and resilient growth.

Below are the key reasons that make Large Cap Funds a compelling investment option:

1. High Stability Through Large-Cap Dominance

One of the strongest advantages of this category is its disciplined portfolio structure. Leading large cap schemes consistently maintain 81% to 93% allocation to large-cap stocks, ensuring the majority of the fund is invested in financially strong, stable, and professionally managed companies.

Such heavy large-cap exposure helps these funds:

Withstand market volatility

Recover faster after corrections

Provide more predictable long-term performance

2. Consistent Long-Term Returns Across Market Cycles

The long-term return profile of large cap funds remains impressive. The top schemes in this category have delivered 5-year returns ranging from ~18% to over 25%, proving their ability to generate steady compounding without taking excessive risk.

Examples include:

Nippon India Large Cap Fund: 25.08% (5-year)

ICICI Prudential Large Cap Fund: 21.85% (5-year)

HDFC Large Cap Fund: 21.60% (5-year)

Tata & Edelweiss: ~18%–19% (5-year)

These numbers highlight the category’s reliability for long-term wealth creation.

3. Exposure to India’s Strongest and Most Trusted Companies

Large Cap Funds invest predominantly in industry leaders that shape India’s economic landscape.

Across the top schemes, the recurring names include:

HDFC Bank

ICICI Bank

Reliance Industries

Bharti Airtel

Larsen & Toubro

Kotak Mahindra Bank

These companies bring:

Strong earnings visibility

Proven business models

Massive market dominance

Better resilience during economic uncertainty

Such blue-chip exposure forms the backbone of the stability investors seek.

4. Better Risk-Adjusted Performance Compared to Aggressive Categories

While mid and small caps can deliver sharper returns, they also carry much higher volatility. Large cap funds, on the other hand, have more favorable risk profiles, reflected through:

Moderate standard deviation compared to other categories

Strong Sharpe ratios in top-performing funds

Lower downside risk due to dominant companies in the portfolio

This makes them ideal for investors who want growth without extreme fluctuations.

5. Ideal for Long-Term and First-Time Equity Investors

Large cap funds offer a balanced pathway for:

New investors entering equity markets

Conservative investors seeking stability

Long-term investors planning for goals like retirement or wealth creation

Anyone wanting predictable compounding with lower volatility

Their consistency, quality holdings, and stability make them a dependable category heading into 2026.

Top 5 Large Cap Mutual Funds to Invest in 2026

Selecting the right large cap fund becomes easier when you compare performance, portfolio strength, and return consistency across leading schemes. Based on the latest available metrics, the following large cap funds stand out for their strong long-term track record, disciplined allocation, and robust blue-chip portfolios.

Each fund summary below is built strictly from the data provided in your document.

1. ICICI Prudential Large Cap Fund

Why it stands out:

This is one of the strongest performers in the large cap category, backed by a massive AUM and consistent multi-year returns.

Key Highlights (as per document):

AUM: ₹73,034.52 Cr

1-Year Return: -2.22%

3-Year Return: 18.77%

5-Year Return: 21.85%

Large Cap Allocation: 81.60%

Top Holdings: HDFC Bank, ICICI Bank, Reliance Industries, L&T, Bharti Airtel

What it means for investors:

A stable, high-quality portfolio with exposure to India’s largest private sector companies and strong sector diversification. Ideal for long-term wealth creation.

2. HDFC Large Cap Fund

Why it stands out:

A veteran fund with a very high large-cap allocation and strong 5-year performance.

Key Highlights:

AUM: ₹38,251.04 Cr

1-Year Return: -6.35%

3-Year Return: 16.98%

5-Year Return: 21.60%

Large Cap Allocation: 93.02%

Top Holdings: HDFC Bank, ICICI Bank, Reliance Industries, Bharti Airtel

What it means for investors:

The fund’s extremely high large-cap exposure makes it one of the most stable choices in the category.

3. Nippon India Large Cap Fund

Why it stands out:

Delivers the highest 5-year return among all large cap schemes in the document.

Key Highlights:

AUM: ₹46,463.11 Cr

1-Year Return: -1.01%

3-Year Return: 19.87%

5-Year Return: 25.08% (highest in category)

Large Cap Allocation: 85.09%

Top Holdings: HDFC Bank, ICICI Bank, Reliance Industries, Axis Bank

What it means for investors:

A strong performer with aggressive yet blue-chip-heavy stock selection that has historically generated superior long-term compounding.

4. Tata Large Cap Fund

Why it stands out:

A steady performer with a balanced allocation and strong long-term stability.

Key Highlights:

AUM: ₹2,683.81 Cr

1-Year Return: -4.53%

3-Year Return: 15.44%

5-Year Return: 19.58%

Large Cap Allocation: 83.92%

Top Holdings: HDFC Bank, ICICI Bank, Reliance Industries, Kotak Mahindra Bank

What it means for investors:

A solid option for investors seeking a stable, quality-driven portfolio without too much mid-cap exposure.

5. Edelweiss Large Cap Fund

Why it stands out:

A clean, diversified large cap portfolio with consistent multi-year performance.

Key Highlights:

AUM: ₹1,336.51 Cr

1-Year Return: -6.44%

3-Year Return: 15.61%

5-Year Return: 18.13%

Large Cap Allocation: 83.69%

Top Holdings: HDFC Bank, ICICI Bank, Reliance Industries, L&T

What it means for investors:

A disciplined, large-cap-focused fund suited for conservative investors who want stability with steady returns.

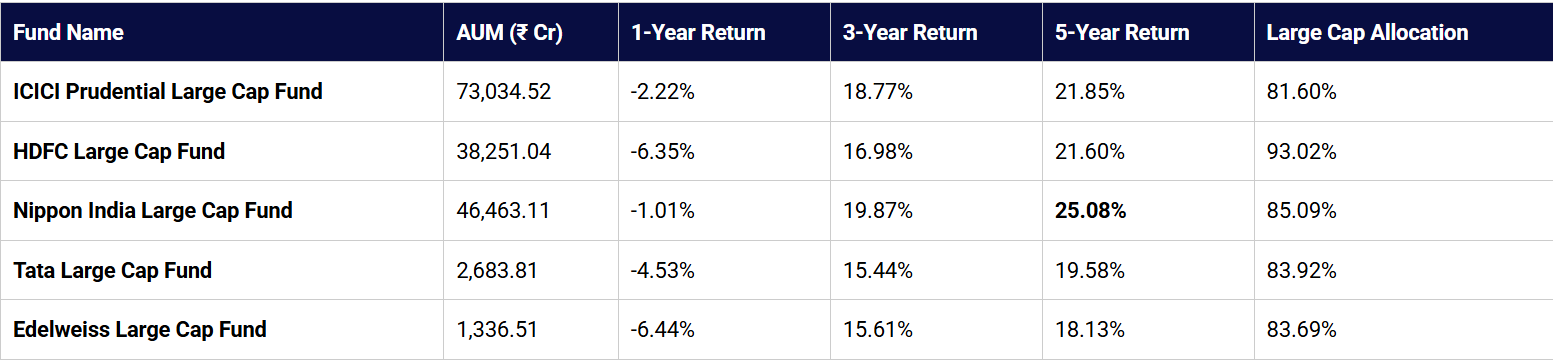

Performance Comparison of Top Large Cap Funds

Below is a clear side-by-side comparison of the top large cap mutual funds based on their AUM, returns, and large-cap allocation. This helps investors quickly understand how each fund performs across different time frames and how aggressively they are positioned within the large-cap universe.

| Fund Name | AUM (₹ Cr) | 1-Year Return | 3-Year Return | 5-Year Return | Large Cap Allocation |

|---|---|---|---|---|---|

| ICICI Prudential Large Cap Fund | 73,034.52 | -2.22% | 18.77% | 21.85% | 81.60% |

| HDFC Large Cap Fund | 38,251.04 | -6.35% | 16.98% | 21.60% | 93.02% |

| Nippon India Large Cap Fund | 46,463.11 | -1.01% | 19.87% | 25.08% | 85.09% |

| Tata Large Cap Fund | 2,683.81 | -4.53% | 15.44% | 19.58% | 83.92% |

| Edelweiss Large Cap Fund | 1,336.51 | -6.44% | 15.61% | 18.13% | 83.69% |

Key Observations

Best 5-Year Performer: Nippon India Large Cap Fund (25.08%).

Highest Large Cap Exposure: HDFC Large Cap Fund (93.02%).

Largest AUM: ICICI Prudential Large Cap Fund (₹73,034.52 Cr).

Most Balanced Allocation: Tata & Edelweiss (around ~84% large cap exposure).

Highest 3-Year Growth: Nippon India Large Cap Fund (19.87%).

What to Look for When Choosing a Large Cap Fund in 2026

Choosing the right large cap fund becomes easier when you focus on a few essential factors. Here are the key things that matter:

1. Consistent Long-Term Performance

Pick funds that have delivered steady returns over 3-year and 5-year periods. In this category, strong long-term performers showed 18%–25% 5-year returns, indicating reliability.

2. High Large-Cap Allocation

Look for funds with 80%+ allocation to large-cap stocks. This ensures stability and lower volatility.

3. Quality of Top Holdings

Check whether the fund invests in strong companies such as:

HDFC Bank, ICICI Bank, Reliance Industries, Bharti Airtel, L&T, etc.

These stocks add strength and reduce downside risk.

4. Fund Manager Experience

Experienced fund managers bring consistency in decision-making and risk control, which is crucial in a core portfolio category like large caps.

5. AUM Size and Stability

Larger AUM funds (like over ₹30,000 Cr) often have better research capabilities and established processes.

Who Should Invest in Large Cap Funds?

Large Cap Funds are suitable for a wide variety of investors because they offer stability, consistent performance, and lower volatility compared to mid and small cap categories. These funds are ideal for first-time equity investors who want a safer entry into the market, as they primarily invest in well-established companies with strong fundamentals. They are also a good fit for investors who prefer smoother returns and minimal fluctuations, making them suitable for those with a lower risk appetite.

If you’re planning for long-term goals such as retirement, wealth building, or financial independence, large cap funds work well due to their ability to deliver steady compounding over time. They also serve as a reliable core holding in a diversified portfolio, providing a strong foundation on which other higher-risk categories can be added. Overall, large cap funds are perfect for anyone seeking stability, moderate growth, and dependable performance from companies that dominate India’s economic landscape.

Need Expert Guidance